OTC Markets Group has published proposed amendments for qualification rules to list on the OTCQX for all companies, including Canadian and other International public companies. These rules are scheduled to become effective on January 1, 2017.

Reserved for global companies listed on a qualified non-U.S. stock exchange to trade their shares, OTCQX International allows companies to establish a secondary market for U.S. investors without the costly and restrictive regulatory requirements of a U.S. exchange listing. Companies on OTCQX may use their home country disclosure in English in lieu of SEC reporting.

Many Canadian listed public companies could qualify for OTCQX if they have Net Tangible Assets of $5 million with less than 3 years operations, or $2 million with 3 or more years of operations, all in $USD. There are other qualifications, none of which should be a problem for TSX, TSX Venture or CSE listed companies.

These proposed amendments reduce the cost and time for companies to list on OTCQX, with the following proposed changes:

OTCQX Rules for International Companies:

Companies are no longer required to retain a PAL on an ongoing basis, and instead must have a qualified attorney, investment bank, or their ADR bank act as an OTCQX Sponsor during the initial qualification process. The Sponsor is primarily responsible for writing a Letter of Introduction to OTC Markets Group on behalf of the Applicant.

Elimination of Annual PAL Letter.

International Companies will no longer be required to provide an annual Issuer Compliance Statement to their PAL.

Removal of the requirement to be included in a Recognized Securities Manual that qualifies for the Blue Sky Manual Exemption. OTC Markets Group is working with the North American Securities Administration Association (“NASAA”) and individual states to gain recognition for OTCQX for the purposes of “Blue Sky Manual Exemption” for secondary trading.

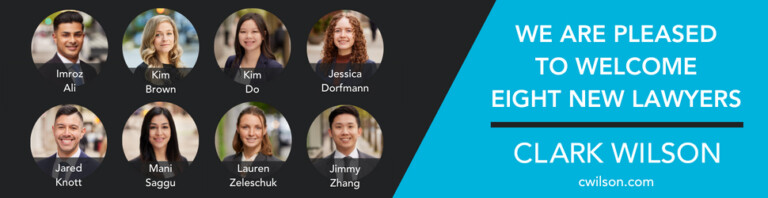

Since 2014, Clark Wilson LLP has been qualified to act as a principal advisor liason, or PAL, for OTC market listings. See this article. We believe that having a local law firm assist in the OTC listing process can save our clients time and money.

The OTC Markets’ comment period on the proposed amendments ends on November 14, 2016.

If you would like assistance with listing on the OTCQX or any OTC Markets exchange, contact Bernard Pinsky at [email protected].